In a world of market uncertainty, retirees and income-focused investors need a robust strategy to generate cash flow while preserving wealth.

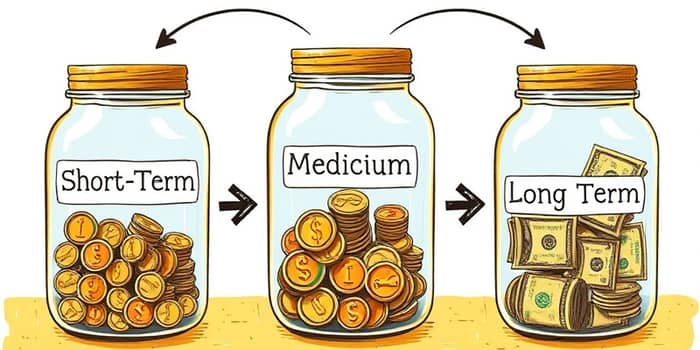

The bucket approach divides assets into segments based on time horizons and risk tolerance. By matching investments to anticipated withdrawal periods, this method aims to deliver a blend of stability and growth.

Originally popular with retirees, this strategy also appeals to anyone seeking consistent cash flow and capital preservation over multiple decades.

A classic bucket structure consists of three parts:

This bucket is designed to cover living expenses for the next one to two years with highly liquid, low-risk assets. It provides a buffer that prevents selling volatile investments during downturns.

By maintaining this reserve, investors experience psychological comfort and discipline during market swings.

Supporting years three through ten, this bucket balances income generation with moderate risk. Its goal is to refill Bucket 1 as needed without excessive volatility.

This segment aims for a higher yield than cash instruments while limiting downside exposure.

The final bucket focuses on growth to protect against inflation and extended retirement horizons. Funds here are not tapped for at least ten years.

Typical holdings include equities, high-yield bonds, growth ETFs, and selective alternative investments. Allocating around 60 percent of the remaining portfolio—roughly $450,000 to $540,000—allows for long-term compounding and inflation protection.

Choosing the right investments for each bucket is critical. Examples include:

Proper diversification across industries, asset classes, and maturities ensures minimizing drawdown and volatility risk and maintaining dependable income.

Consider a retiree with a 1 million dollar nest egg requiring 125,000 dollars per year of income. Social Security and pensions cover 75,000 dollars, leaving 50,000 dollars to be generated from investments.

The breakdown might look like this:

To keep the strategy on track, follow a detailed step-by-step replenishment process:

1. Withdraw from Bucket 1 each year to meet living expenses.

2. When funds are depleted, transfer distributions from Buckets 2 or 3.

3. Rebalance annually to realign with original allocation targets.

Engaging a financial professional can enhance decision making and tailor the approach to individual goals.

Advantages include:

Potential drawbacks include:

To sidestep errors, avoid overloading the short-term bucket, diversify asset types, and adhere to a review schedule. Ignoring market shifts or delaying rebalancing can undermine the plan’s effectiveness.

By dividing a portfolio into tailored buckets, investors can achieve a harmonious balance of liquidity, income, and growth. This structured approach addresses sequence-of-returns risk and timing issues while offering a clear roadmap for sustainable withdrawals.

With careful selection of income-producing assets, disciplined maintenance, and professional guidance, the bucket strategy empowers retirees and income-focused investors to pursue financial peace of mind for years to come.

References