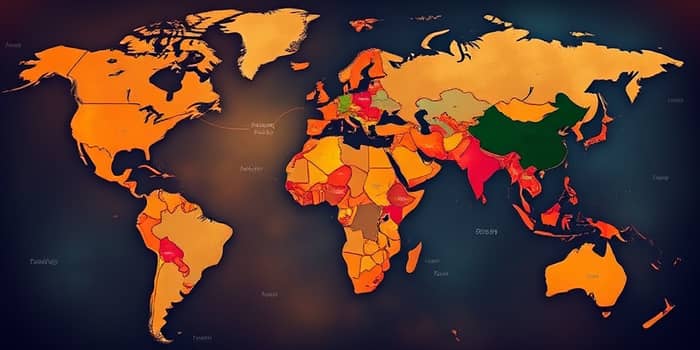

As global inflation moderates, many emerging economies are entering a new phase of opportunity. Average inflation in these markets is projected to fall to 5.5% in 2025, down from about 8% in 2023 and 7.74% in 2024. By comparison, advanced economies expect inflation at 2.5%, while the global rate is forecast at 4.3%. This shift is not just a statistical improvement; it signals a critical turning point for investment flows and economic stability across diverse regions. Lower consumer prices can encourage spending, while easing monetary policy may pave the way for fresh capital inflows. The potential for sustained price stability offers a foundation for deeper structural reforms and growth acceleration.

Emerging markets have long been associated with volatile price pressures, driven by external shocks, supply chain bottlenecks, and fluctuating currency values. In recent months, central bank measures and the gradual easing of energy costs have combined to curb inflationary forces. This downward trend underscores the success of credible and responsive central banks in maintaining price stability without sacrificing growth momentum.

China’s experience is particularly notable: inflation has remained flat at 0% for two consecutive years, and forecasts suggest similar performance in 2025. Meanwhile, most other emerging economies are converging around the 5.5% mark. For investors and policymakers alike, these figures represent a lasting signal that price conditions are stabilizing, reinforcing long-term confidence in growth prospects. Improved inflation outlooks also reduce the pressure on currency reserves, boosting the capacity of central banks to respond to future shocks.

The moderation of inflation has prompted major central banks—the US Fed, ECB, and Bank of England—to begin cutting rates from mid-2024. Emerging market policymakers, observing these moves, have room to follow suit, potentially loosening financial conditions after a period of restrictive policy. The result could be more affordable credit, higher consumer and business confidence, and a boost to domestic demand.

These factors collectively illustrate how lower inflation has boosted investment appetite for frontier and established markets alike, reinforcing a virtuous cycle of slowing prices and strengthening growth signals.

Recent investor surveys highlight renewed interest in equity and bond markets of select emerging economies. Lower borrowing costs and improved earnings outlooks have translated into positive net capital inflows, especially in Asia and parts of Latin America.

While many emerging economies benefit from cooling inflation, outliers persist. Russia, for instance, registered inflation near 9.9% in early 2025 and maintains a policy rate of 21%. High commodity prices and fiscal pressures have sustained price rises, posing a challenge for monetary authorities. Investors weigh these dynamics carefully when allocating capital.

At the other end of the spectrum, China’s economy demonstrates exceptionally low inflation rates in China, reflecting weak domestic demand in certain sectors and purposeful monetary support. This contrast underlines the diversity within emerging markets: some regions leverage strong consumption to manage price stability, while others battle persistent upward pressure on costs.

Several smaller markets such as Bolivia, Ghana, and Turkey remain in the double-digit inflation category, underscoring how structural constraints and fiscal imbalances can prolong price pressures. Addressing these outliers will require targeted policy action to stabilize local currencies and manage budget deficits.

Despite easing inflation, GDP growth in emerging markets is expected to slow modestly to around 3.7% in 2025, down from a decade-long average near 4%. Even so, this rate is more than double the roughly 1.5% pace anticipated for advanced economies. Resilient local demand and improving services activity have insulated many markets from global headwinds. Manufacturing sectors, however, face challenges from uneven global demand and continued trade disruptions, suggesting that growth may become more uneven across regions.

These challenges illustrate how policy uncertainty and geopolitical risks remain on the radar for investors. Amid these dynamics, central banks must carefully monitor labor markets and credit conditions to avoid premature easing. Authorities that strike the right balance can optimize growth without reigniting inflationary pressures.

Services sectors across emerging markets have shown surprising strength, with selling price increases slowing to their lowest pace in nearly two years. This sectoral resilience supports overall economic activity and creates job opportunities. At the same time, technology and manufacturing segments continue to navigate supply chain realignments and tariff pressures.

Investors increasingly eye opportunities in green energy and sustainable initiatives, anticipating long-term returns and policy support. In India, for example, solar capacity auctions have accelerated project pipelines, while in Brazil, wind power investments are drawing institutional funding. Similarly, tech hubs in Southeast Asia are leveraging lower capital costs to expand digital infrastructure.

As inflation cools, many emerging market central banks may cut policy rates, reducing borrowing costs and supporting both corporate investment and consumer spending. However, to sustain this positive momentum, authorities must balance monetary ease with careful oversight of financial stability risks. Effective policy coordination—combining prudent fiscal frameworks with transparent communication—remains essential.

A clear picture of key metrics highlights the opportunity set:

With these indicators in mind, portfolio managers and government officials can calibrate strategies that leverage sustained service sector performance alongside broader growth objectives.

Countries that maintain strong external positions and clear regulatory environments are likely to benefit the most from the favorable inflation backdrop.

Lower inflation presents a window of opportunity for emerging markets to reinforce structural reforms, deepen capital markets, and enhance fiscal sustainability. However, the potential for sudden policy shifts—whether in response to fiscal imbalances or external shocks—requires vigilance. By embedding digital transformation and inclusive growth policies, economies can build resilience against future downturns.

Moreover, emerging markets must navigate global challenges such as rising debt burdens and climate-related risks. Achieving sustainable growth amid evolving trade patterns and shifting global alliances could define the next chapter of emerging market success. Policymakers and investors who remain proactive, informed, and adaptable will be best positioned to seize the promise of this new era.

References