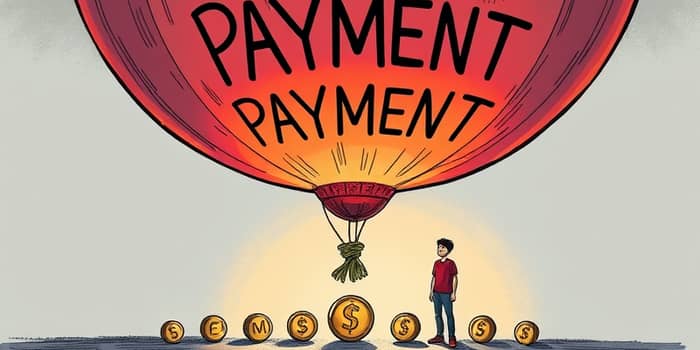

Understanding the hidden risks within certain loan structures can mean the difference between steady growth and financial downfall. Balloon payments, in particular, can create a sudden, overwhelming burden at the final stretch of repayment.

This article delves into every facet of balloon loans—from their design to the strategies you can employ to protect yourself—and equips you with the knowledge to avoid costly surprises.

At its core, a balloon loan defers the bulk of the principal balance to the very end of the term. Unlike fully amortizing loans, where each payment chips away at both interest and principal, balloon loans often require only interest or a small principal portion in monthly installments. At maturity, the borrower must pay a large one-time lump sum that can exceed all prior payments combined.

Such loans are structured so that borrowers enjoy the illusion of affordable monthly payments. This arrangement may appeal to those who anticipate a future influx of capital or who plan to refinance or sell the underlying asset before the due date. However, the strategy hinges on timing and market conditions, turning into a high-stakes gamble for anyone unprepared.

Balloon loans show up in various financial products, each carrying its own context and risk profile. Common areas include:

Borrowers must recognize that while the structure appears flexible, it demands disciplined foresight and backup plans.

To illustrate, imagine a business loan of $1,000,000:

• Monthly payments might be set at $8,333 for five years, paying down $500,000 of the principal over that period. The remaining $500,000 becomes due in one payment at term end.

• Alternatively, if payments cover only interest, the entire $1,000,000 principal could be due in a single balloon payment.

Such sums can be staggering when the expectation to refinance or sell falls through. Borrowers have faced severe credit damage or foreclosure when they underestimate the final obligation.

Whether you’re a homeowner, vehicle buyer, or business proprietor, balloon structures carry inherent danger. The central challenge is the uncertainty surrounding the large payment due at maturity:

• If you cannot muster the funds or secure refinancing, lenders may pursue foreclosure on property, repossession of vehicles, or legal judgment on business obligations.

• Market downturns can erode asset values, making refinance terms less favorable or impossible. Rising interest rates or changing credit requirements only amplify the risk.

Because of these dangers, balloon loans are generally excluded from U.S. federal “Qualified Mortgage” rules. Such regulatory stances exist to protect consumers from taking on obligations beyond their means.

In certain environments, balloon loans offer attractive features when managed carefully:

These strategies demand rigorous contingency plans and continuous monitoring of market conditions.

Before signing on the dotted line, ask yourself whether you are ready for this critical financial planning decision. Consider these best practices:

By taking proactive steps and conducting a thorough risk assessment, you can avoid the shock of a payment you did not expect.

If the thought of a large final obligation causes unease, consider less risky financing options:

Strong alternatives include:

Choosing the right structure hinges on your risk tolerance, cash flow projection, and market forecast.

In the world of finance, knowledge is power. By recognizing how balloon payments function and the scenarios that lead to success or disaster, you position yourself to make wise, forward-looking decisions. Whether you opt for a balloon loan or an alternative, the key is disciplined preparation, conservative assumptions, and ongoing vigilance.

When the end of term arrives, you’ll be ready to meet your obligations without fear, confident in the path you charted and the plan you put in place.

References